As an adult, you are the only one who can make decisions regarding your finances and health care. A Durable Power of Attorney protects your financial and health care decisions, should you not be able to. Moreover, without these critical documents, you’ll likely risk a time-consuming and stressful legal proceeding where the Court will decide who makes those imperative decisions for you.

Read on to learn what you need to know about the Durable Power of Attorney process and start planning ahead, today.

Starting a Durable Power of Attorney

What’s one of the first building blocks to creating a good estate plan? To establish a Durable Power of Attorney, which includes developing documents that outline and protect your financial and health care wishes. With these documents, you will appoint an “agent”, otherwise referred to as a “guardian of the estate” in finance and “guardian of the person” in healthcare. And, you can appoint the same person.

These “agents” will then have the legal authority to act on your behalf in the event of your death or incapacity. Additionally, every adult – whether you’re married or single – should have both documents.

Can’t My Spouse Make Decisions on My Behalf?

Unfortunately, if the right paperwork isn’t in order, things can get messy.

Because of the Wisconsin State Law, your spouse may retain access to many of your jointly titled assets. However, they do not have the legal right to make decisions for you if they haven’t been appointed as your Power of Attorney, regardless of how long you have been married. Therefore, make sure to document who will handle your financial and health care wishes while you are able to do so.

Need one-on-one guidance? Contact us so we can help.

What Responsibilities Can My Financial and Health Care Agents Anticipate?

The financial agent and the health care agent have completely separate roles. Because of this, we’ve detailed how each role is handled.

Guardian of the Estate

Should you become incapacitated or unable to make financial decisions, your financial power of attorney will act on your behalf. This person is known as the “Guardian of the Estate.” He or she will also have to file a detailed annual account of how your assets have been spent throughout the year.

Guardian of the Person

The individual who oversees and reports annually on your personal welfare is called the “Guardian of the Person.”

In the health care power of attorney document, there is also a section in which you can detail your specific wishes, such as your willingness to be an organ donor or any religious preferences you may have. That being said, your selected agent has a clear understanding of how to follow through with your personal health care choices.

What Happens if You Don’t Have One or Both?

Should you become incapacitated and have not signed both powers of attorney, this could cause some concerns and a legal proceeding called a “Guardianship” will be required. Furthermore, a Court would declare you to be incompetent and will your legal rights to make decisions over to a “Guardian” to exercise on your behalf.

Most noteworthy, once a Guardianship has been put into place, it is almost always permanent.

There are exceptions…

The only way to reverse a Guardianship would be to prove to the Court’s satisfaction that your mental competence has been restored. Because of this, Guardianship is a stressful, time-consuming and expensive legal proceeding. So, why not avoid yourself a headache by having the proper powers of attorney in place? Don’t you want to be the one choosing your agents to ensure your wishes are carried out?

According to USA Today, 64% of Americans don’t have a will. So, why not take control of your choices today?

In short, a Durable Power of Attorney is inexpensive and can be customized to your needs. It also serves as a legal safeguard for you, which is so important and your loved ones. If it’s time to make sure your healthcare and financial decisions are handled, let us help. We are more than happy to make sure all of the right documents are in place. After all, you are the one in control of your own choices.

Get one-on-one assistance here.

Contact

Estate Plans for Singles

As a Single Person, Do I Really Need an Estate Plan? The Answer: Yes.

One of the biggest misconceptions about estate planning is that it is only important for those who are married. Estate Plans for singles ensures that your assets and responsibilities are properly assigned to the right people. In fact, while estate planning might be a little more complex for single individuals, it is just as crucial.

Continue reading to learn why.

What Happens Without an Estate Plan or Will?

By law, the individual’s parents are the next-of-kin and will be responsible to carry out their child’s legacy wishes and distribution of assets. Unfortunately, their parents may not be in a position to take on that additional responsibility. Maybe the individual would have preferred someone closer in age, such as a sibling. Unfortunately, neither the family nor the Court would have any way of knowing this without a documented estate plan or will.

Is there a “Default” Plan for Singles?

Yes. The State of Wisconsin has a “default” plan for dealing with a single person’s incapacity or death. However, it is even less likely to resemble their desired outcome than with married individuals. This is why, in part, it is even more important for singles to execute financial and health care powers of attorney than it is for married individuals.

Need Help Creating Your Estate Plan?

Control Your Assets – IRA’s, Life Insurance, Real Estate & Bank Accounts

With an Estate Plan, assets that name a specific beneficiary, such IRA’s or life insurance will be distributed to the chosen person(s) named. Nevertheless, assets that do not have beneficiary designations, such as real estate, bank or brokerage accounts, will go through the probate process and Wisconsin law will control those benefits.

What if I have Children?

If the deceased had children, the assets will go to the children, who will then receive their inheritance outright or when they reach age 18. If the deceased did not have children, his or her parents will be the beneficiaries.

What Happens Without a Named Beneficiary?

If the parents are also deceased, then siblings, or even nieces and nephews, will receive the estate, which may not be what was intended. If any of these individuals receive government benefits, this unplanned inheritance will almost certainly interfere with those benefits. This is another reason estate planning for singles is so important.

What Can I Do to Take Back Control?

The only way for a single individual to truly control that outcome is to put a proper estate plan in place.

Issues can arise when a single individual passes away without an estate plan in place. Take the stress away from the unknown and plan your next steps for a will and estate plan. If you’d like to learn more details about taking these next steps, visit our FAQ Page by clicking here.

Need Help Creating Your Estate Plan? We Can Contact You!

Contact

“More than 50 Percent of Adults Do Not have a Will,”

according to Chas Rampenthal, general counsel of LegalZoom.

Like this article? Please share it:Is an Estate Plan Important for Parents with Young Children? Yes.

You want what’s best for your children. And, should anything ever happen to your and or your spouse, you want to know that they will remain loved and protected with a guardian you trust. That’s why creating an Estate Plan that outlines thorough details in a Will should be at the top of your list. Why? Sometimes the unthinkable occurs. An Estate Plan is designed to help you provide the best possible care and protection for your children, should a guardian ever be needed.

Read on to explore why Estate Planning will be the best thing you do for your children.

1. Give Yourself Peace of Mind – Guardianship

An Estate Plan covers many areas, such as personal health care decisions, who will receive your assets, in addition to who will have guardianship over your children. If one parent dies, the surviving parent will usually have custody of the minor children as they are the natural guardian. However, if both parents pass away, a Court will assign guardianship.

In the Court’s assessment, they will look first to the ‘Last Will and Testament‘ of the deceased parent(s). This is a legal document detailing the parents’ choice for caretakers. It is important to understand, however, that although the parents have nominated the guardian in the Will, only a Court can actually appoint the guardian. The Court usually confirms the nomination of the parents, with the understanding that this was a thoughtful, purposeful decision on their end.

Are there any Exceptions?

There are some instances, however, when the Court, based on additional information and recommendations by family and professionals, will appoint someone other than the parents’ first choice. For this reason, it is important to nominate at least one alternate choice for a guardian in the Will.

2. Protect Your Child’s Future by Assigning a Guardian

If neither parent had a Will nominating a guardian, the Court will look next to family members. Many times there is a clear best choice and both sides of the family agree. However, without a Will, the situation can become quite problematic. What if multiple family members step forward, each believing he or she is the best choice?

Don’t leave your child’s guardianship to chance. It can result in a stressful, even bitter, prolonged and expensive proceeding that is difficult for everyone, particularly the children.

3. Consider Having a ‘For Now’ Guardian in Your Estate Plan

If you are having trouble choosing a guardian, it’s okay to nominate somebody that you might replace at some point in time. Pick someone “for now.” Children and relationships change, and your first choice of a guardian may change as well.

4. Make Sure You Have It in Writing

Most of us never think about dying. But sadly, not all parents live long enough to see their children grow up. As parents, you need to be prepared for the worst case scenarios and you need to have your preferences made known. Merely telling others who you want to care for your children isn’t enough. A guardian is only properly nominated when it is done in a Will.

Naming a guardian is perhaps the last and best gift that you could give to your children and family members. If you’re ready to secure your children’s future, Estate Planning can be simple (with the right guidance!). But, don’t wait too long. It doesn’t matter how little your children are. You want to make sure you’ve got a guardian in place so he or she can provide love and protection, should anything ever happen to you and your spouse. If you’d like to read more about how services and how to get started, click here.

What is a Trust and is it Important to Have One?

As an Estate Attorney, I’m often asked the question, “What is a Trust? Do you believe it’s important for me to have one?” The short answer: a trust is a three-party legal relationship that is an extremely valuable tool to use in your estate plan. And, if relevant to your financial situation, it’s very important to have one.

The long answer: When creating a trust, there are many factors to consider. There are also many benefits. With a trust, you are able to specify the distribution of your wealth to whomever you choose, conserve your legacy, and – in most cases – avoid probate. Continue reading to understand all the pertinent details and the benefits of having a trust. Also, keep in mind, should you decide to have one, legal counsel is advised and I’d be more than happy to help out.

Let’s Dig Deeper into the Question, “What is A Trust?”

A trust is a legal relationship or fiduciary agreement. One person, the “Grantor” (also known as a “Donor”, “Settlor”, or “Trustor”), transfers property to another person known as the “Trustee.” The Trustee holds the property, managing and using it for the benefit of a third person, known as the “Beneficiary”.

The property can be almost anything:

- Money

- Real Estate

- Business Interests

- Securities

Depending upon the type of trust, the Grantor, Trustee, and Beneficiary may be three different individuals. In some instances, they may all be the same person. The document which creates this relationship and spells out the terms is known as the “Trust Agreement.”

Once created, a Trust is a legal entity which is capable of owning property. It may even have its own taxpayer identification number and have to file income tax returns.

Types of Trusts

Trusts are usually defined by two characteristics. The first characteristic is the point in time at which the trust was created. The second characteristic which defines a trust is whether it is “revocable” or “irrevocable.”

Revocable Living Trusts

This type of fiduciary agreement has become increasingly popular. As the name implies, this is an “inter vivos” and “revocable” trust. This means the trust is created during the Grantor’s lifetime and keeps the authority to amend or revoke it. The Grantor, Trustee, and Beneficiary are all the same person. The usual purpose is to provide for the transfer of the Grantor’s assets to the beneficiaries upon the Grantor’s death. This will help to prevent going through the court-supervised probate process.

With a revocable trust, the Grantor keeps the authority not only to change the terms of the trust, but also the authority to revoke, or undo the trust completely.

Testamentary or Irrevocable Trust

A Testamentary trust is created during the Grantor’s lifetime through the Last Will and Testament of the parents. It is a common type of trust that allows the parents to provide for their children’s financial needs. For example, in the event of the parents’ death, a more mature, financially responsible person is named Trustee. They manage the money until the children are older.

This type of trust may not be changed or revoked. Even by the Grantor, once it has been properly created, property held in an irrevocable trust cannot be removed. Property that has been placed in a revocable trust can be removed by the Grantor at will.

Special Needs Trust

Similar to a Testamentary or Irrevocable Trust is a “Special Needs Trust”. This allows the parent, or another person, to provide financial support for a disabled beneficiary. It also helps to keep any governmental benefits (such as Medicaid or SSI) they may receive. Click HERE to learn more about this type of trust.

Funding the Trust

Putting property in a trust, a process also referred to as “funding the trust,” occurs when the Grantor transfers ownership of the property to the trust. Although the trust is the actual owner, the Trustee is the legal representative. Therefore, the Trustee’s name is usually used in the new title designation. For example, if John Smith created a trust for himself, but named his daughter, Jane, the Trustee of that trust, the new title designation may read “Jane Smith, Trustee of the John Smith Trust.”

Also, keep in mind that the Trustee has no personal ownership of the assets. He or she only holds and manages the property in accordance with the instructions described in the trust agreement, as well as other restrictions or authority permitted by law.

Caution should always be used when funding a trust because changing the title to the asset may not necessarily be the correct action to take. With some assets, it may be more appropriate to change the beneficiary designation. The purpose of the trust, as well as the type of asset (real estate vs. savings account vs. IRA), will dictate what should be done. Proper guidance from either a financial or legal professional should always be sought when funding a trust.

Looking to Get Started or Learn More?

Looking to Get Started or Learn More?

Now that you’ve covered all of the detail, you should be able to offer some insight to others when they ask, “What is a Trust?” Just make sure to remind them that a Legal Attorney will help them through the planning process. What works for you might not work for your neighbor and visa versa.

If you’d like assistance in adding this tool to your estate plan, I’d be happy to offer guidance. You can reach me 414.430.1722, connect with me via email, or fill out a form on my contact page.

Like this article? Please share it:How a Special Needs Trust Can Protect Your Disabled Loved One

Have you been told that you cannot leave money to a disabled son, daughter, or grandchild? If they receive certain Government benefits, it’s true. Fortunately, there is a solution to this problem. Read on to understand how a Special Needs Trust is in your loved one’s best interest. Learn how to plan carefully so you’re not jeopardizing your loved one’s ability to receive Supplemental Security Income (SSI) and Medicaid benefits.

What Government Benefits Have Asset Restrictions?

Benefits that have asset restrictions include Supplemental Security Income (SSI), Medicaid, and subsidized housing. Unfortunately, if the individual has more than the maximum amount, his or her benefits will be interrupted. If you want to leave money upon your death or a gift during your lifetime to someone with a physical or mental disability, or a person who is chronically ill, you must know your legal rights and plan carefully.

How have I been able to protect my clients? By helping them set up a Special Needs Trust as part of their estate plan.

What is a Special Needs Trust?

You can leave money to your loved one without interfering with the public benefits by setting up a Special Needs Trust (also referred to as a Supplemental Needs Trust). This type of trust enables a person with a disability or chronic illness to have an unlimited amount of assets held for his or her benefit.

That being said, instead of leaving property directly to your loved one, you leave it to this trust. The assets held in the trust as not considered “countable” assets in determining whether the individual qualifies for the benefits because the individual does not own them, rather the trust does. The trust, in turn, provides for extra items or care over and above what the government provides.

How Can the Trust Be Used?

The Special Needs Trust can pay for many of the items or services your loved one may want or need in the future. For example, Medicaid won’t pay for certain medical treatment, so the trust can step in and pay for it. If Medicaid will only pay for a basic piece of medical equipment, the trust can provide whatever additional funds are necessary to pay for a nicer model. The trust can pay for alternative treatments, vitamins and supplements, massages, and even grooming supplies.

The Trust can also pay for those extras that may not be medically necessary, but which would definitely increase the disabled person’s quality of life, such as summer camp, airline tickets for travel (including a companion, if necessary), electronic games, computer equipment, nicer furniture or even a larger television.

What Assets Can Be Used to “Fund” A Special Needs Trust?

Almost any type of asset can be used to “fund” a special needs trust, including life insurance proceeds, other inheritances or lifetime gifts. Once the trust is established, other family members or friends can add to the trust through their own estate plans.

Who Manages the Trust?

The trust funds are managed, administered and distributed by the trustee. The trustee should be someone who gets along well with the disabled person and has his best interests at heart as he is the one who will decide if and when any money is distributed. The trustee should also be someone who is comfortable managing money and has a track record of being responsible with their own money.

What is a Pooled Trust?

If you do not have a good candidate to serve as trustee, or if you intend to leave only a modest amount of money to the trust, consider using a “pooled trust.” A pooled trust is a type of special needs trust that is run by a non-profit organization which pools and invests funds from many families. Under the pooled trust structure, each disabled person still has a separate account for those funds added by his family which are used only for his benefit, but all of the funds are invested and managed as a whole.

Setting Aside Money to Trusted Relatives Can Backfire.

It may seem smart to leave money to a trusted relative for your disabled loved one. Unfortunately, even when all the parties have the best of intentions, things can and do go wrong. For example, if the “holder” of the money dies, those funds will automatically be distributed to his or her beneficiaries. They may not want to use it for the disabled person.

Additionally, once the “holder” receives the money, it is legally theirs. No matter what the agreement, he or she can’t be “forced” to use it for the disabled person. They could also be involved in litigation, bankruptcy, or divorce, and none of those legal proceedings would differentiate between the money he is “holding” for the benefit of the disabled person and his own assets.

In short, the use of a Special Needs Trust would solve these problems while ensuring that the funds are used solely to enrich the life of the disabled person.

Let’s Connect.

If you’d like to learn more or set up a Special Needs Trust as part of your estate plan, let’s talk. We can meet at my office, located in Elm Grove, Wisconsin, or I am happy to make a house visit. You can reach me by clicking below or contacting me at 414-430-1722.

Like this article? Please share it:

Understanding the Wisconsin Marital Property Law | For Better or Worse

Are there wedding bells in your future? If yes, congratulations! While this is one of the more significant occasions in your life, have you and your future spouse taken the time to have a serious conversation about the Wisconsin Marital Property Law? I’m guessing you haven’t – and that’s okay. As a Legal Attorney with more than 25-years of understanding this complicated law, I’m a great resource.

Continue reading to review some of the most commonly asked questions about the Wisconsin Marital Property Law. If you’ve still got questions, let’s sit down and talk face to face. I’m truly happy to help.

Most Commonly Asked Questions | Wisconsin Marital Property Law

What is the Wisconsin Marital Property Law?

The Wisconsin Marital Property Law was enacted in 1986 to ensure all marital assets (and debts) were distributed equally, in the event of divorce. As one of nine states abiding by the Community Property Law, Wisconsin courts base distribution on a number of factors, such as earnings, length of the marriage, property brought into the marriage, etc.

In short, understanding this law is important as it controls the ownership of your marital assets and, in the event of a divorce, will control every element of your finances.

Does It Matter if I Earn Most or All of the Income?

No. In most cases, property and proceeds are divided regardless of who earns all or most of the income. Whatever you acquire as a couple throughout your marriage – including debt – will belong the both of you equally.

For example, think about your spouse’s 401(k). Over time, this account’s value grows as a result of contributions, interest, and dividends. You will have equal marital interest in the account, even though the 401(k) is titled in your spouse’s name.

When Does the Law Come into Effect?

If you’re getting married in the state of Wisconsin, and you and your future spouse are both Wisconsin residents, the law will go into effect the day you legally say, “I do.” This is also known as the “determination date.” If you’re an out-of-state newly married couple, the determination date will be enacted once you both become Wisconsin residents.

What is Separate Property?

Think of separate property as the assets that belong to you or your spouse – individually – before your determination date. Individual property could also include gifts or property that are inherited.

In the event of a divorce or death, separate property is exempt from distribution in all states. However, if it is mixed with the couple’s marital property, it will likely become marital property. For instance, if your spouse deposits a check received as an inheritance (which is individual property) into your joint investment account, it is likely going to become marital property.

Can You Change the Effect of the Wisconsin Marital Property Law?

Yes. However, the effect of the law can only be changed – or avoided entirely – by having a documented marital property agreement. This agreement outlines your rights and obligations with respect to your property and your spouse’s property. Additionally, it is usually signed before you get married, but it can be executed afterward, too.

A Legal Attorney Can Help

There is a lot of work that goes into planning for your big day. And while no one wants to talk about divorce during this celebratory time, it is important to understand how the Wisconsin Marital Property Law could potentially impact your future – for better or worse. If you are entering a second marriage (click HERE to read my blog on estate planning for a second marriage) or in a blended family, you will especially want to know how the law affects your unique situation.

It’s my job to educate my clients about their legal rights. If you’re looking to be more informed, let’s talk. Click below to set up an appointment.

Like this article? Please share it:Do I Need an Estate Plan? Where & When Do I Begin?

True or False? Without a proper estate plan, the legal and financial issues raised by your death – or your incapacity – will be more difficult and expensive for your loved ones. Unfortunately, this is true. And, in most cases, many of us procrastinate planning ahead. Why? Because thinking about death or disability – and then sitting down to plan for it it – is an unpleasant prospect. It’s far easier to focus on the more immediate concerns in our lives.

A good Legal Attorney is key to help you document an estate plan that works for your unique situation. Your plan will involve a number of legal documents, the most common of which are Wills or Revocable Trusts, Guardianship, Beneficiary Designations, and Financial & Health Care Powers of Attorney. Before any documents can be drafted, however, there are initial steps you will need to take, in addition to a number of detailed issues you’ll need give some preliminary thought. For example…

Take Stock of Your Finances.

Compile a detailed list of your assets and your liabilities. While the primary purpose of your estate plan is to address a non-financial goal – to take care of your loved ones – the best approach is often determined by your financial situation.

Consideration for Your Children.

Choosing someone to raise your children in the event of your death will force you to decide what values are most important to you. Here are a few examples of the values many parents need to consider:

- Religious Beliefs

- Cultural Identity

- Parenting Styles

- Education

- Family Size

- Geographical Location

- Financial Skills

You’ll also need to consider whether your children are mature enough to manage their inheritance. If not, the funds should be placed in a trust for their benefit. That being said, you’ll need to consider who the trustee should be. The trustee will not only manage the trust funds but also decide when and why to make distributions to your children.

Lastly, if you have a blended family, consider how much you wish to leave to your children, and how much to your spouse.

Any Other Beneficiaries?

If you do not have a surviving spouse or children, who should receive your assets? Would you like to leave your money to other family members, your church, your favorite charities, or all of the above?

What About You?

If you become incapacitated, but do not die, who should manage your finances? Who should make decisions regarding your healthcare? What values are important to you regarding your health care? I will walk you through these tough, but important questions so you are best prepared.

Getting Started with Your Estate Plan is the Hardest Part.

As with most things in life, getting started on your estate plan is the hardest part because you’re forced to think about stuff that’s not easy. Once the initial stages are completed, however, the rest of the process should flow smoothly. Also note, anytime is a good time to get started and no estate is too large or small. As your Legal Attorney, I can get you started on this important planning process today.

Like this article? Please share it:Everything You Need to Know about Estate Planning for Your Second Marriage

Before you say “I do” a second time around, you need to be prepared. Estate planning for your second marriage is imperative. And, as your Estate Attorney, I will help you and your future spouse take care of the complicated stuff so you can focus on the fun part of getting remarried.

Wisconsin is a Marital Property State

This is one of the first things you and your future spouse should know. Why? Your marriage will affect the ownership of all of your assets, regardless of how the asset is titled, which means: change in ownership will affect the division of your assets in the event of a divorce and/or upon your death.

In many instances, failing to revise your estate plan will result in a distribution that is substantially different from what you intended. So, you need to revise or prepare a well-documented estate plan. To learn more about how you and your new spouse can be protected, click below to connect.

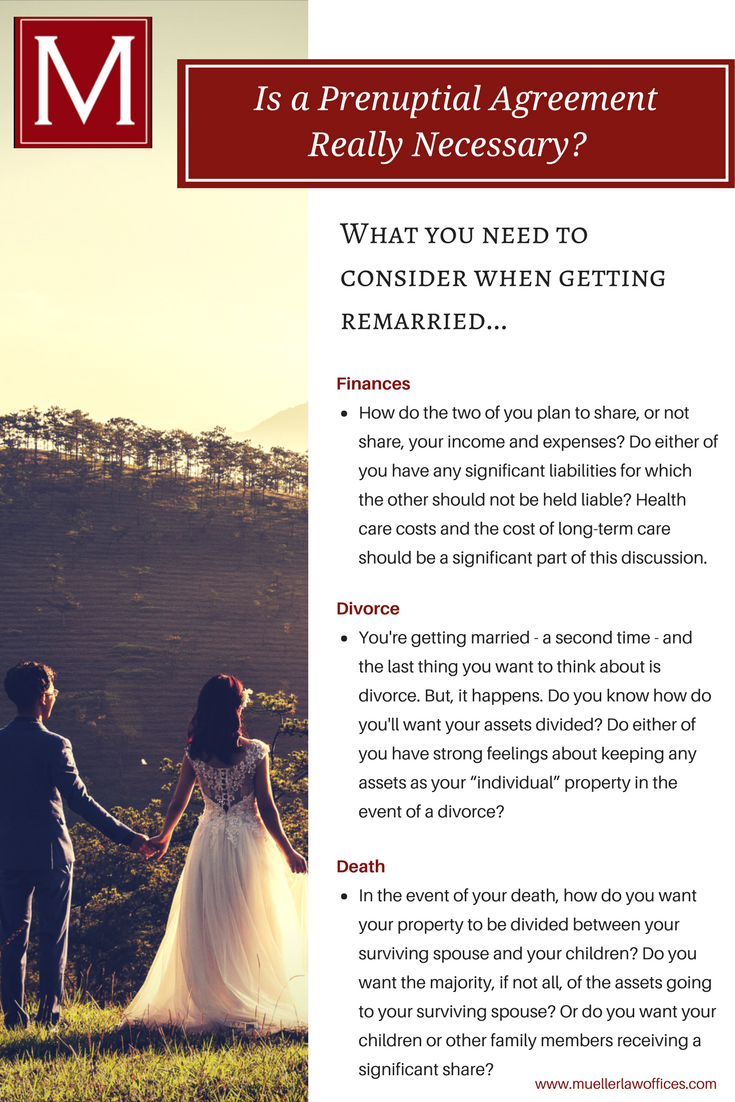

Finances Are Often More Complex

You and your future spouse’s respective financial situations are probably a little more complex than when you first married. Why? It’s possible you have more assets or income. Or, one or both of you may have children from previous relationships. In either of these cases, it may be in both parties’ interest to execute a prenuptial agreement.

Here are the most significant issues to address when determining whether or not a prenuptial agreement is needed…

If it is in your best interest to sign a prenuptial agreement, the rest of your estate planning documents (Wills, Revocable Trusts, Powers of Attorney, etc.) should be updated. Your estate plan must reflect both of your decisions and your new marriage.

Estate Planning for Your Second Marriage is Imperative – Let’s Get You Prepared.

If love is in the air a second time around, and you’re ready to get remarried, reach out. I have more than 25-years of experience helping couples manage the legal complications of getting married a second time. Again, this should be a celebratory time. Estate planning for your second marriage will keep protected down the road.

Like this article? Please share it:Wisconsin’s Marital Property Law

Wisconsin’s marital property law became effective on January 1, 1986. The law was enacted to formally recognize that both spouses contribute to a marriage even though only one may earn an income. Under the marital property law, whatever the couple acquires during the marriage belongs to them equally, regardless of whose name is on the title. This applies not only to earned income, but also unearned income such as interest and dividends. For example, if one spouse has a 401(k), and over time the account’s value grows as a result of additional contributions, as well as interest and dividends generated by the securities held in the account, the other spouse has an equal marital interest in the account even though it is actually titled only in the contributing spouse’s name. It is important to note, however, that marital property law applies to a couple’s debt and liabilities in the same manner as it does their property.

Like this article? Please share it:How do your assets get to your loved ones following your death?

Everyone wants to take care of their loved ones to the greatest extent possible in the event of their own death. However, ensuring that your estate goes to your beneficiaries in the manner you intended is not as simple as it may seem. This process is known as “estate planning.” There are a number of strategies and tools in the estate planning process and no “one size fits all” approach. The following is a brief discussion of the various means by which the individual assets which make up your estate may transfer to your beneficiaries.

Like this article? Please share it:Estate Planning: Where do I begin?

Whatever the size of your estate, it is important to plan. Without a proper estate plan, the legal and financial issues raised by your death, or your incapacity, will be more difficult and expensive for your loved ones. Unfortunately, most of us procrastinate because thinking about, and then actively planning for, death or disability is an unpleasant prospect. It is far easier to focus on the more immediate concerns in our lives. However, while estate planning may seem like a daunting task, it need not be. As with almost everything else, getting started is the hardest part.

Like this article? Please share it:Estate Planning for Unmarried Couples

There are many unique issues for unmarried couples to consider in the estate planning process. Because there is no “legal” relationship between the parties, it is critically important that these issues be addressed before problems arise. If left too late, you run the risk that your significant other may have no rights and could end up being entirely removed from your life, both personally and financially. So what documents should you put in place?

Like this article? Please share it:Estate Plans for Single Individuals

As a Single Person, Do I Really Need an Estate Plan? The Answer: Yes.

One of the biggest misconceptions about estate planning is that it is only important for those who are married. Estate Plans for singles ensures that your assets and responsibilities are properly assigned to the right people. In fact, while estate planning might be a little more complex for single individuals, it is just as crucial.

Continue reading to learn why.

What Happens Without an Estate Plan or Will?

By law, the individual’s parents are the next-of-kin and will be responsible to carry out their child’s legacy wishes and distribution of assets. Unfortunately, their parents may not be in a position to take on that additional responsibility. Maybe the individual would have preferred someone closer in age, such as a sibling. Unfortunately, neither the family nor the Court would have any way of knowing this without a documented estate plan or will.

Is there a “Default” Plan for Singles?

Yes. The State of Wisconsin has a “default” plan for dealing with a single person’s incapacity or death. However, it is even less likely to resemble their desired outcome than with married individuals. This is why, in part, it is even more important for singles to execute financial and health care powers of attorney than it is for married individuals.

Need Help Creating Your Estate Plan?

Control Your Assets – IRA’s, Life Insurance, Real Estate & Bank Accounts

With an Estate Plan, assets that name a specific beneficiary, such IRA’s or life insurance will be distributed to the chosen person(s) named. Nevertheless, assets that do not have beneficiary designations, such as real estate, bank or brokerage accounts, will go through the probate process and Wisconsin law will control those benefits.

What if I have Children?

If the deceased had children, the assets will go to the children, who will then receive their inheritance outright or when they reach age 18. If the deceased did not have children, his or her parents will be the beneficiaries.

What Happens Without a Named Beneficiary?

If the parents are also deceased, then siblings, or even nieces and nephews, will receive the estate, which may not be what was intended. If any of these individuals receive government benefits, this unplanned inheritance will almost certainly interfere with those benefits. This is another reason estate planning for singles is so important.

What Can I Do to Take Back Control?

The only way for a single individual to truly control that outcome is to put a proper estate plan in place.

Issues can arise when a single individual passes away without an estate plan in place. Take the stress away from the unknown and plan your next steps for a will and estate plan. If you’d like to learn more details about taking these next steps, visit our FAQ Page by clicking here.

Need Help Creating Your Estate Plan? We Can Contact You!

Contact

“More than 50 Percent of Adults Do Not have a Will,”

according to Chas Rampenthal, general counsel of LegalZoom.

Like this article? Please share it:Estate Planning for Parents of Young Children

Most of us never think about dying. But sadly, not all parents live long enough to see their children grow up. Sometimes the unthinkable occurs. If you pass away, what will happen to your children? Who will raise them? If one parent dies, the surviving parent will usually have custody of the minor children as the natural guardian. However, if both parents pass away, then a Court will decide who will become guardian. In its assessment, the Court will look first to the Last Will and Testament of the deceased parent(s), the document in which parents name their choice for guardian. It is important to understand, however, that although the parents have nominated the guardian in the Will, only a Court can actually appoint a guardian. The Court usually confirms the nomination of the parents with the understanding that this decision was not made lightly by the parents. There are some instances, however, when the Court, based on additional information and recommendations by family and professionals, appoints someone other than the parents’ first choice. For this reason it is important to nominate at least one alternate choice for guardian in the Will.

Like this article? Please share it:Authorization for Final Disposition

The Authorization for Final Disposition is a document which allows you to designate a representative who will have the legal authority to make decisions regarding your funeral arrangements and the disposition of your body. This document is still fairly new in the State of Wisconsin. Absent a signed Authorization, Wisconsin law designates who has such authority. The law establishes the following order of priority: 1) surviving spouse or domestic partner; 2) surviving child or children; 3) surviving parent or parents; 4) surviving sibling or siblings; 5) lineal descendants in the priority order spelled out in the Wisconsin Statutes; 6) the guardian at the time of death; and 7) any other person willing to control the funeral and final disposition who attests in writing that they have made a good faith effort and could not locate any of the persons in the above priority list.

Like this article? Please share it:Durable Powers of Attorney

The first two building blocks of a good estate plan are the General Durable Power of Attorney, also referred to as a financial power of attorney, and the Durable Power of Attorney for Health Care. Every adult should have both. As an adult, you are the only one who can make decisions with regard to your own finances and health care. There are only two means by which someone else could obtain the authority to make those decisions for you. The first is through the use of the two powers of attorney. With these documents, you yourself appoint “agents,” one for your finances and one for your health care. These individuals then have the legal authority to act on your behalf in the event of your incapacity. Having both of these documents is just as important if you are married as it is if you are single. In the State of Wisconsin, although your spouse may retain access to many of your jointly titled assets, he or she does not have the legal right to make decisions for you, regardless how long you have been married.

Like this article? Please share it:Estate Planning FAQs

1. What is estate planning?

Estate planning is a process. It involves people—your family, other individuals and, in many cases, charitable organizations of your choice. It also involves your assets (your property) and the various forms of ownership and title that those assets may take. And it addresses your future needs in case you ever become unable to care for yourself.

Through estate planning, you can determine:

Like this article? Please share it:The Benefits of Creating a Trust to Hold a Child’s Inheritance

Providing for children in the event parents die prematurely takes more than choosing a guardian to raise them. Parents must also consider what will happen to any money or property their children will inherit. Children under the age of eighteen cannot directly inherit more than a small amount of money. With assets and life insurance, most parents will leave their children a great deal more than that. If the parents have made no provisions, a guardian will be appointed to manage the assets only until the child turns eighteen, at which point all the remaining assets are turned over the child. Creating a trust to hold the inheritance instead allows parents significantly more control over how the inheritance is spent for their children.

Like this article? Please share it:Living Will vs. Durable Power of Attorney for Health Care

In the State of Wisconsin there are two separate health care advance directives: the Durable Power of Attorney for Health Care and the Declaration to Physicians (commonly called the Living Will). As advance directives, both are designed to provide direction regarding your health care and treatment in the event that you are no longer able to make your wishes known. Beyond that, however, the two are very different documents.

Like this article? Please share it:Memorandum of Tangible Personal Property

One of the many things that you will need to consider when preparing your estate plan is how you would like your personal effects to be distributed. Almost everyone has an item of special meaning that they would like distributed to a certain person. Traditionally, these requests were included in the Last Will and Testament or the revocable trust documents. The disadvantage to this method was that whenever you wanted to make a change, whether it be changing the item or the recipient, or adding additional items, you had to sign a codicil to your Will or an amendment to your revocable trust. This would incur additional costs because the Codicil or the amendment had to be executed with the same formalities as the Will or revocable trust, which usually meant a trip to the attorney’s office.

Like this article? Please share it:How to Protect Your Disabled Loved One with a Special Needs Trust

Have you been told that you cannot leave money to a disabled son, daughter, or grandchild? If they receive certain Government benefits, it’s true. Fortunately, there is a solution to this problem. Read on to understand how a Special Needs Trust is in your loved one’s best interest. Learn how to plan carefully so you’re not jeopardizing your loved one’s ability to receive Supplemental Security Income (SSI) and Medicaid benefits.

What Government Benefits Have Asset Restrictions?

Benefits that have asset restrictions include Supplemental Security Income (SSI), Medicaid, and subsidized housing. Unfortunately, if the individual has more than the maximum amount, his or her benefits will be interrupted. If you want to leave money upon your death or a gift during your lifetime to someone with a physical or mental disability, or a person who is chronically ill, you must know your legal rights and plan carefully. How have I been able to protect my clients? By helping them set up a Special Needs Trust as part of their estate plan.

What is a Special Needs Trust?

You can leave money to your loved one without interfering with the public benefits by setting up a Special Needs Trust (also referred to as a Supplemental Needs Trust). This type of trust enables a person with a disability or chronic illness to have an unlimited amount of assets held for his or her benefit. That being said, instead of leaving property directly to your loved one, you leave it to this trust. The assets held in the trust as not considered “countable” assets in determining whether the individual qualifies for the benefits because the individual does not own them, rather the trust does. The trust, in turn, provides for extra items or care over and above what the government provides.

How Can the Trust Be Used?

The Special Needs Trust can pay for many of the items or services your loved one may want or need in the future. For example, Medicaid won’t pay for certain a medical treatment, the trust can step in and pay for it. If Medicaid will only pay for a basic piece of medical equipment, the trust can provide whatever additional funds are necessary to pay for a nicer model. The trust can pay for alternative treatments, vitamins and supplements, massages and even grooming supplies. The Trust can also pay for those extras that may not be medically necessary, but which would definitely increase the disabled person’s quality of life, such as summer camp, airline tickets for travel (including a companion, if necessary), electronic games, computer equipment, nicer furniture or even a larger television.

What Assets Can Be Used to “Fund” A Special Needs Trust?

Almost any type of asset can be used to “fund” a special needs trust, including life insurance proceeds, other inheritances or lifetime gifts. Once the trust is established, other family members or friends can add to the trust through their own estate plans.

Who Manages the Trust?

The trust funds are managed, administered and distributed by the trustee. The trustee should be someone who gets along well with the disabled person and has his best interests at heart as he is the one who will decide if and when any money is distributed. The trustee should also be someone who is comfortable managing money and has a track record of being responsible with their own money.

If you do not have a good candidate to serve as trustee, or if you intend to leave only a modest amount of money to the trust, consider using a “pooled trust.” A pooled trust is a type of special needs trust that is run by a non-profit organization which pools and invests funds from many families. Under the pooled trust structure, each disabled person still has a separate account for those funds added by his family which are used only for his benefit, but all of the funds are invested and managed as a whole.

Additional Benefits of a Special Needs Trust

While it may seem like a good idea simply to leave a set amount of money to a sibling or other close relative, with the understanding that the money will be spent on the disabled person, this strategy often backfires. Once the “holder” receives the money, it legally belongs to him, and he cannot be forced to use it for the disabled person. Even when all the parties have the best of intentions, things can still go wrong. If the “holder” of the money passes away, those funds will be distributed to his or her beneficiaries, who may not want to use it for the disabled person. The “holder” may at some later point in time be involved in litigation, bankruptcy or a divorce. None of those legal proceedings would differentiate between the money he is “holding” for the benefit of the disabled person and his own assets.

The use of a Special Needs Trust would solve these problems while ensuring that the funds are used solely to enrich the life of the disabled person.

Let’s Connect.

If you’d like to learn more or set up a Special Needs Trust as part of your estate plan, let’s talk. We can meet at my office, located in Elm Grove, Wisconsin, or I am happy to make a house visit. You can reach me by clicking below.

Like this article? Please share it:What You Need to Settle Your Affairs

A Checklist of Documents You Will Need to Settle Your Affairs After You Die

• List of Funeral Instructions and prepaid funeral contracts

• Medicare Card/Health Insurance Card

• VA File Number, Military discharge papers

• Birth certificate and Death Certificate

• Marriage license or Divorce Decree

• Prenuptial/postnuptial agreements

• Revocable/Living Trust agreements

• Last Will and Testament

What is a Trust?

Trusts: An Explanation of What They Are and How They Could Benefit You

A trust is a legal relationship in which one person, the Grantor, transfers property to another person known as the Trustee. The Trustee then holds the property, managing and using it for the benefit of a third person, known as the beneficiary. The property can be almost any type of property- money, real estate, business interests, securities, etc. The Grantor may also be referred to as the Donor, Settlor or Trustor. Depending upon the type of trust, the Grantor, Trustee and Beneficiary may be three different individuals, or in some instances, they may all be the same person. The document which creates this relationship and spells out the terms is known as the “trust agreement.” Once created, a trust is a legal entity which is capable of owning property. It may even have its own tax payer identification number and have to file income tax returns.

Like this article? Please share it:Organizing Your Most Important Papers

One thing each of us can do for the future is to get our personal and financial records in order. These records are both useful and something you will need on numerous occasions throughout your lifetime, including annual income tax preparation, financial planning and estate planning. It may even be relatives or friends who will need it in the event that something has happened to you. If you become incapacitated or pass away, your loved ones will need this information and documentation to take over your financial affairs, deal with insurance claims, apply for government benefits (such as medical assistance), or to settle your personal and financial affairs in the event of your death. You’re doing your loved ones a tremendous favor by keeping good records. Your filing system doesn’t need to be elaborate, just organized. The following is a list of what records you should maintain and how long you should maintain them.

Like this article? Please share it:When a Loved One Dies

A Checklist of What to Do When a Loved One Dies

When a loved one passes away, it is an understandably stressful time. It can be even more stressful and/or traumatic trying to remember all of the details that must be taken care of related to a person’s death. If you are in charge of handling the affairs of the decedent (the person who has died), here is a checklist of some of the more important considerations:

Like this article? Please share it: